Easily manage and access your money on your Green Dot card at any time.

The Green Dot app is designed to help you manage any Green Dot debit card or bank account! This includes the Unlimited Cash Back Bank Account by Green Dot Bank - a new kind of mobile bank account to help you earn and save more. If you’re not using Green Dot Bank, you could be missing out on hundreds of dollars per year. Better Banking. Bigger Rewards!

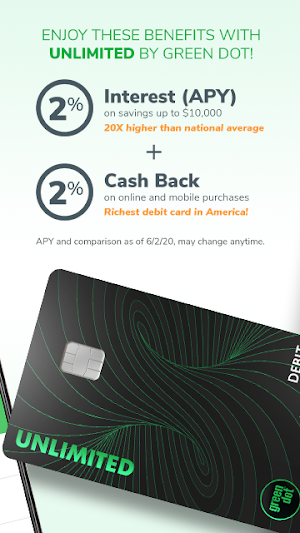

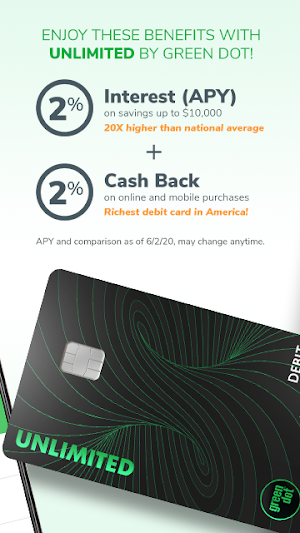

• Earn 2% UNLIMITED cash back on online and mobile purchases

• Save up money in the Green Dot High-Yield Savings Account and earn up to 2% annual interest

• Free ATM network

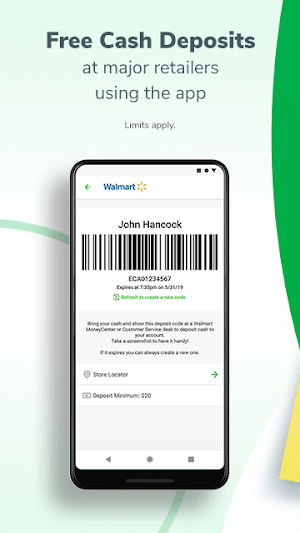

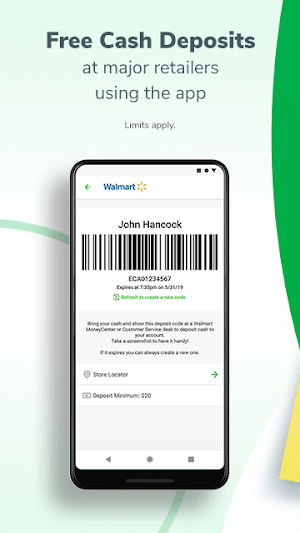

• Free cash deposits using the app

• Get your pay up to 2 days early and government benefits up to 4 days early with ASAP Direct DepositTM

• NO overdraft fees

• NO minimum balance requirement

Easily manage any Green Dot Bank account at any time. This app allows you to…

• Sign up for or register a new account

• View balance and transaction history and see other account information

• Pay bills and P2P money to friends who have a Green Dot account.

• Deposit checks from your mobile phone

• Works with contactless pay options including Apple Pay (Android Pay for Android Store)

• Set up account alerts

• Access chat customer support

Want to know more? Visit GreenDot.com today.

See the Account Agreement for pricing details and limits.

Card issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A., Inc. Interest paid every 12 months based on the average daily balance of the prior 365 days, up to a maximum balance of $10,000. Annual Percentage Yields (APYs) are accurate as of 6/2/20 and may change before or after you open an account. The average national savings account interest rate of 0.06% is determined by the FDIC as of May 11, 2020. National rates are calculated based on a simple average of rates paid (uses annual percentage yield) by all insured depository institutions and branches for which data are available. Savings account rates are based on the $2,500 product tier. Visit https://www.fdic.gov/regulations/resources/rates/ to learn more. Direct Deposit timing depends on deposit verification and when we get notice from your employer or benefits provider, and may vary from pay period to pay period. Mobile payment limits, qualifications, and enrollment requirements may apply.

© 2020 Green Dot Bank, Member FDIC,

Green Dot Corporation NMLS ID 914924.

Technology Privacy Statement: https://m2.greendot.com/app/help/legal/techprivacy

Terms of Use: https://m2.greendot.com/legal/tos

With Netspend's suite of products, you're in charge.Features like direct deposit offer...

Join the first all-digital bank in the country!Varo Bank Account: Rated 4.5/5...

indi is smart banking for independent workers. Bank on the go, save...

Current is the future of banking. Spend, save, and manage your money...

Account opening is subject to registration and ID verification.¹Say hello to the...

Do you need a checking account for your small business? Novo is...

Frequently Asked Questions(FAQ)

Created with AppPage.net

Similar Apps - visible in preview.