Hi there !

Thanks for coming by and sparing your valuable time.

I am an underwriter (Credit Manager) and always wanted to have a go to light weight app for quick calculation to help me take decisions on loan applications. So I had developed this app and now publishing it here for everyone's use.

App is free (without ads or in app purchase), light weight, easy to use, intuitive to understand and is quick to perform calculation, offline and very useful for home buyers, property consultants, property agents, loan agents, banking professionals, vehicle shop owners, financial consultants, financial counselors, Direct Selling Agents or DSA, Credit Managers, Credit Appraisers, Loan Appraisers etc

Useful for calculating Loan EMI or Loan eligibility for SBI, HDFC, ICICI, LIC, RBL, HDFC Bank, AU Small Finance Banks, etc

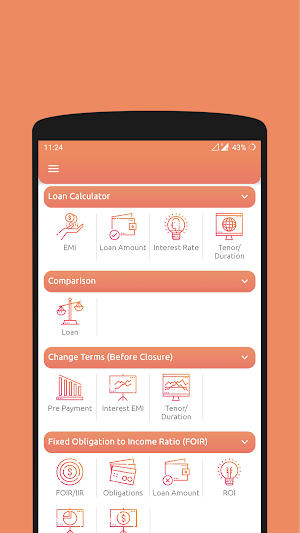

One can calculate the following things in the app,

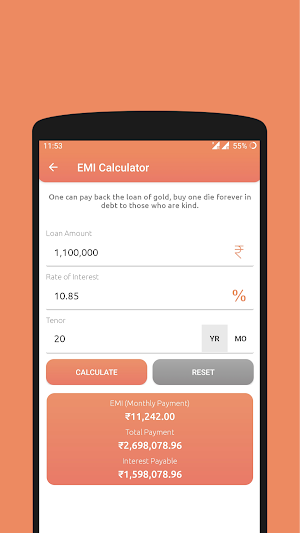

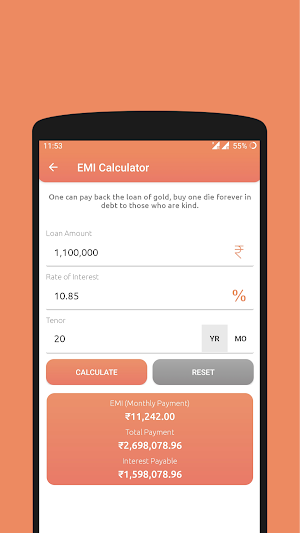

• Calculate EMIs for any loan like home loan, Car loan, Personal loan, Education loan, Bank loan etc

• Calculate the EMIs with tenure of years or months

• Calculate Total Interest Payable

• Calculate Total (Principal + Interest) Payable

• Calculate EMI or Tenure or Loan Amount or Interest Rate by entering other three values.

• Loan Amount (LA) eligibility calculator - Calculate the LOAN AFFORDABILITY based on the affordable EMI

• Rate of Interest (ROI) - Interest rate calculator

• Tenor (Years/Months) - Calculate the Term based on the affordable EMI for a Loan Amount

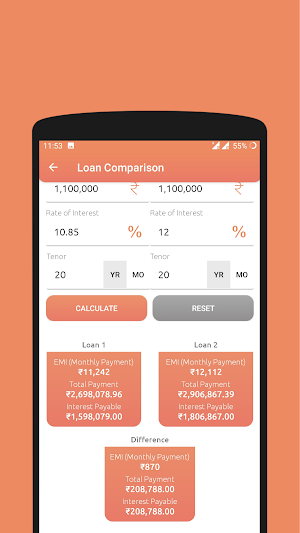

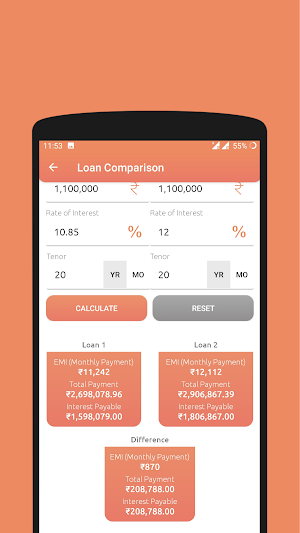

• Compare two loans side by side with various rate of interest, tenure etc

• Prepayment – Calculate effect on Loan EMI on part prepayment of loan

• Change in ROI (increase or decrease) – Calculate effect on Loan EMI on change in ROI during the tenure

• Change in Tenor (increase or decrease) – Calculate the effect on Loan EMI on change in term or tenure

• Fixed Obligation Income Ratio (FOIR) or Instalment Income Ratio (IIR) – Calculate the FOIR or IIR based on Income and Loan EMI to understand the loan eligibility

• FOIR/IIR based Loan Amount, ROI, Tenor, Income and Obligations

• Loan to Value (LTV) – Calculate the Loan exposure compared to collateral value or property value

• LTV based Loan Amount and Property Value

• FOIR + LTV - FOIR + LTV is one of the key metrics that plays a vital role in loan appraising.

• FOIR + LTV based Obligation, Income, ROI and Tenor.

• Calculate Flip or Step Up EMI or Staggered EMI Payments based on different incomes and obligations.

Where to Use:

» Home Loan

» Car Loan

» Bike Loan

» Gold Loan

» Personal Loan

» Property Loan

» Mortgage Loan

» Compare Loans

Hope this app brings value to you

Do share your feedback/suggestions at loanemicalc@gmail.com alternatively you can also rate the app and share your feedback down below.

You feedback is like oxygen to me, so please keep it pumping.

Thanks for your time.

Cheers,

Amit Bavishi

Version 2.0.1

Minor Bugs and issues resolved

Version 2.0.2

Added new functionality of Flip or Step Up Payment or Staggered Payments option

Version 2.0.3

Minor Bugs and issues resolved

Version 2.0.4

Low RAM mobile issue fixed

Website:

Please visit our Loan EMI Calculator website https://loanemicalculator.net/ for more information.

Privacy Policy:

Please refer the privacy policy at https://loanemicalculator.net/privacy

Your time-saving, one-stop due diligence and investment monitoring app! Trusted by enterprise...

Welcome to Fundle, the mobile app designed to provide a comprehensive suite...

Fisco helps you keep track of your finances. Monitor income and expenses...

Created with AppPage.net

Similar Apps - visible in preview.