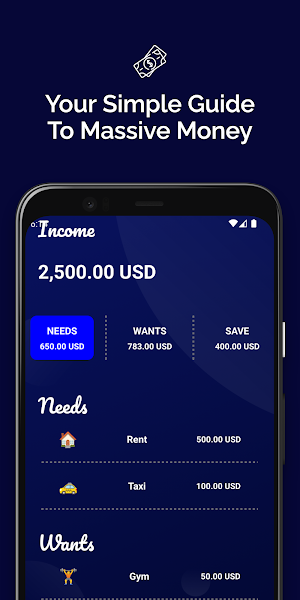

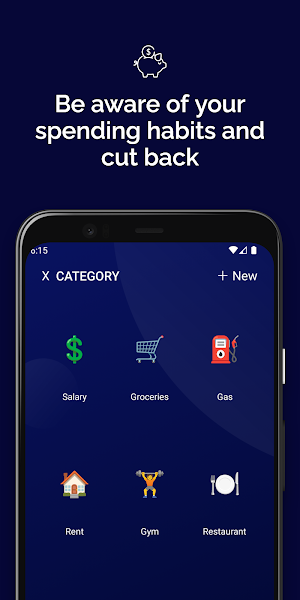

Create a budget for yourself every month.

• Keep track of all your income

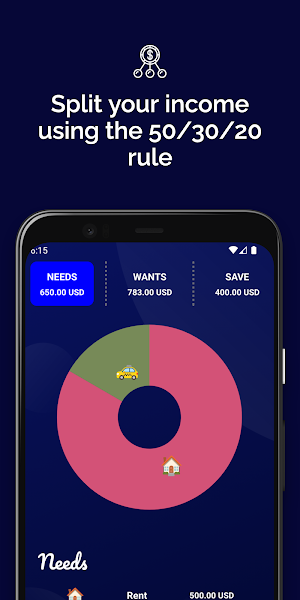

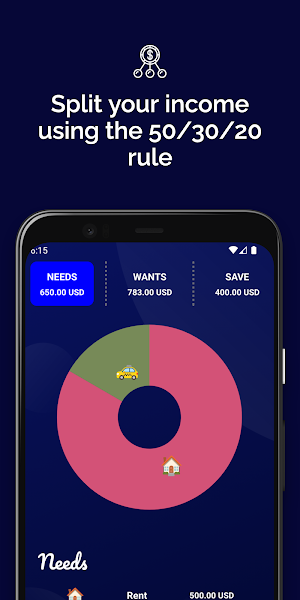

• Split your income using the 50/30/20 rule

• Be aware of your spending habits and cut back

Your budget will be your guide towards the financial freedom you seek.

FINANCIAL NEEDS

Your needs are:

• Utilities

• Housing

• Transportation

• Food, water and clothes

The app helps you to keep your needs at 50% of your total net income.

FINANCIAL WANTS

Your wants are:

• Clothing that isn't essential

• Dining out or ordering take out

• Hobbies, traveling, large house, and new expensive car

The app helps you to budget your wants within 30% of your monthly net income.

SAVINGS

Pay yourself every month towards:

• Retirement or long-term savings

• Short-term savings for a new car or vacation

• Emergency funds of 6-12 months of living expenses

Put 10% of your net income towards savings each month.

As long as you have a mobile phone, computer or tablet, you...

Forget the notepad and spreadsheets to be able to organize your accounts...

Earn coins, deposit coins and generate coins, and earn income.Today, everyone wants...

Main app components:Chart Patterns – automated chart pattern recognition engine identifies 27...

Investkaar - One app that gives you a complete picture of stock...

Frequently Asked Questions(FAQ)

Created with AppPage.net

Similar Apps - visible in preview.